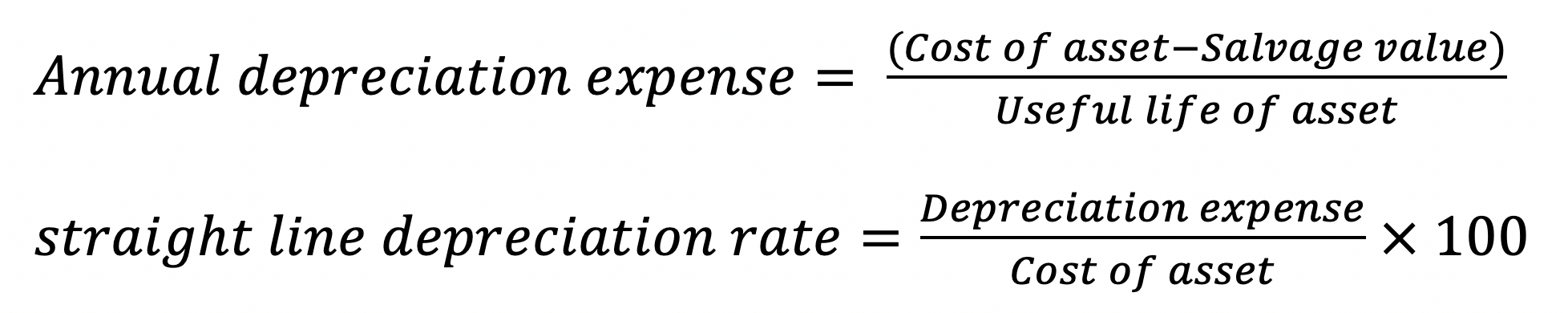

Yearly depreciation formula

X Number of Depreciation Days x Depr. Owns machinery with a gross value of 10 million.

Depreciation Formula Calculate Depreciation Expense

The yearly depreciation of that asset is 1600.

. WHO World Health Organisation also uses the average to know the yearly death and birth rate during a particular time. Calculate yearly depreciation to be booked by Mark Inc on 31122019 and 31122020. Read more on furniture.

It is a contra-account the difference between the assets purchase price and its carrying value on. Relevance and Uses of Average Formula. If you use this method you must enter a fixed yearly percentage.

Straight Line Depreciation Formula The following algorithms are used in our calculator. Many companies and organizations use average to find out their average sales average product manufacturing average salary and wages paid to labor and employees. Final Year Depreciation Expense.

Formula for Straight-line depreciation method Cost of an asset - Residual valueuseful life of an asset. Accumulated depreciation recorded Accumulated Depreciation Recorded The accumulated depreciation of an asset is the amount of cumulative depreciation charged on the asset from its purchase date until the reporting date. 8000 divided by 5 years is 1600.

The calculation of yearly depreciation under WDVM for 2019 and 2020 is as follows. 10000 minus 2000 is 8000. Basis 100.

How is it calculated. Depreciation Amount Declining-Bal. The depreciation per period the value of the asset minus the final value which is.

This accelerated depreciation method allocates the largest portion of the cost of an asset to the early years of its useful lifetime. The following formula calculates depreciation amounts.

Depreciation Expense Double Entry Bookkeeping

Depreciation Calculation

1 Free Straight Line Depreciation Calculator Embroker

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Double Declining Balance Method Of Depreciation Accounting Corner

Aasaan Io Blog

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Definition Formula Calculation

Depreciation Rate Formula Examples How To Calculate

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Rate Formula Examples How To Calculate

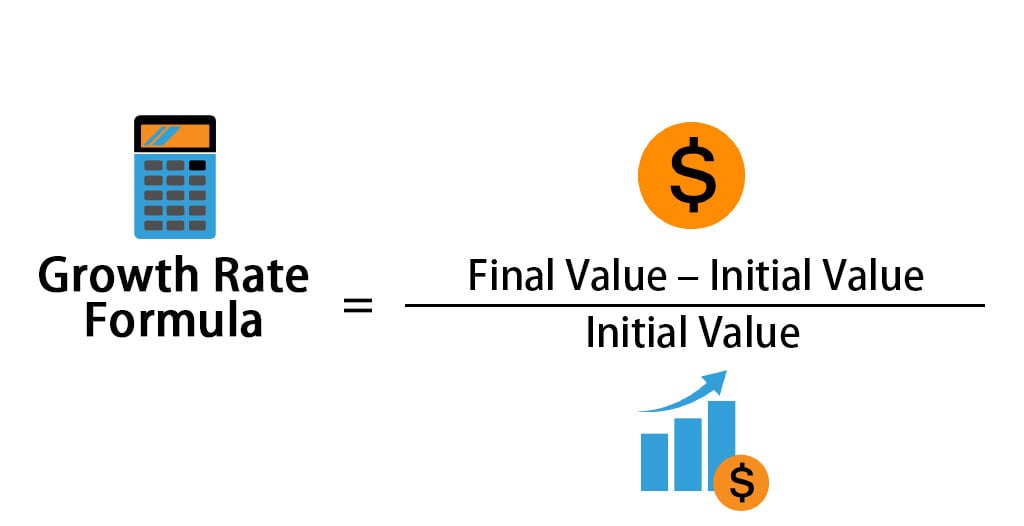

Growth Rate Formula Calculator Examples With Excel Template

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping